Despite recent restrictive trade policies adopted by the United States, North America remains an indispensable commercial partner for Europe. The key driver has been the consolidation of EU-Canada relations under the Comprehensive Economic and Trade Agreement (CETA) between the European Union and Canada.

Eight years after the agreement’s implementation, bilateral trade has flourished, pushing European agri-food exports to record levels. According to estimates from the European Commission, exports of processed agricultural products, food, and beverages to Canada have grown by 80%, reaching an overall value of approximately €3 billion.

Within this broad-based expansion—spanning meat, fruit and vegetables, and wine—the cheese sector stands out as the most dynamic performer.

ITALY TAKES CENTER STAGE IN 2026

In early 2026, attention is firmly focused on Italy. Italian cheeses have emerged as the most dynamic category within the food and beverage sector. In the first eight months of the year, the value of Italian dairy exports to Canada climbed to approximately €85 million, marking a year-on-year increase of 31.8%.

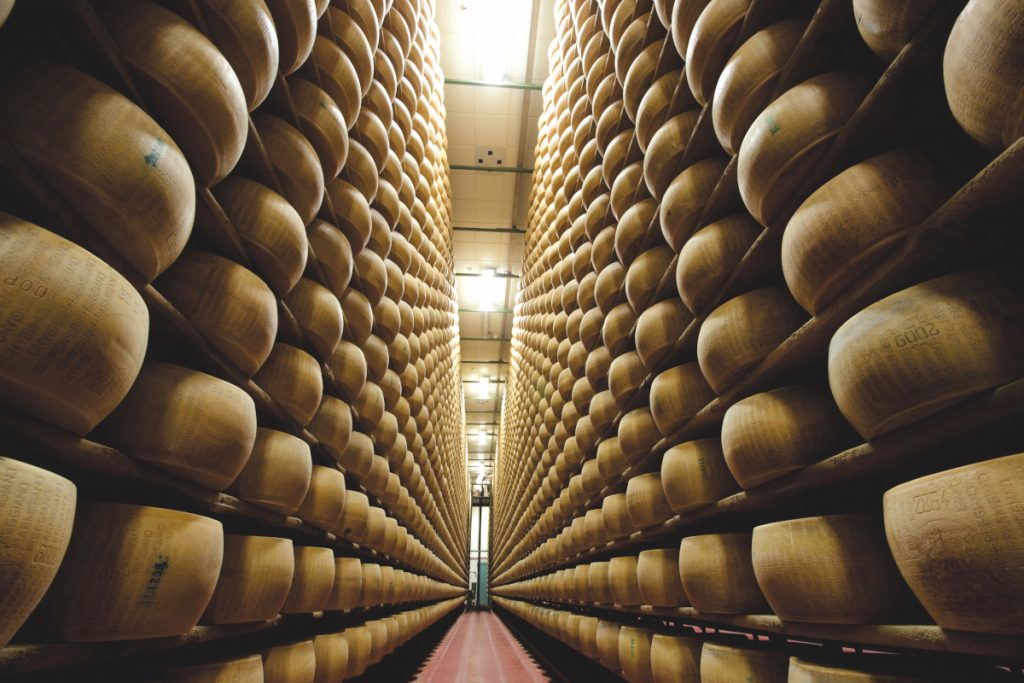

This exceptional performance has been driven primarily by hard and semi-hard cheeses, which account for the largest share of the market, with more than €73 million in trade value.

Yet in terms of growth intensity, fresh cheeses lead the field. Mozzarella, in particular, has delivered a remarkable +40.4% increase, reflecting changing consumer preferences and the growing integration of international flavors into Canadian households. Grated, processed, and blue cheeses have also contributed to the positive trajectory, albeit with more moderate volumes.

A TWO-HORSE RACE: ITALY AND THE UNITED STATES

Italy’s ascent is notable not only for its pace but also for its competitive positioning. With a 25% share of total Canadian cheese imports, Italy nearly doubles France’s 11.8% share.

French producers maintain a solid foothold in segments such as Gouda, Brie, and Camembert, particularly in francophone provinces like Québec, where cultural affinities continue to favor products from across the Atlantic. However, the real contest for market leadership is not intra-European but continental. The United States, leveraging geographic proximity and the USMCA trade framework, holds a 26.7% market share—slightly ahead of Italy.

Italian products, however, enjoy stronger penetration in provinces such as Ontario, where a well-established Italian community and a broader culture of culinary multiculturalism support demand for premium imported cheeses.

STABLE CONSUMPTION, EVOLVING HABITS

On the consumption side, the Canadian market appears mature yet receptive. Per capita cheese consumption stands at 15 kg annually. With inflation easing, purchasing habits have remained stable. At the same time, a significant cultural shift is underway: Canadians are increasingly incorporating foreign cheeses into their daily cooking, using them as ingredients to reinvent home cuisine.

Retail remains the dominant sales channel, accounting for 65% of total market share—a level that has remained high even after the pandemic. Large supermarket chains manage mass-market cheeses such as Cheddar and Emmental, typically produced domestically and positioned as snack staples.

By contrast, premium Italian products—such as PDO Parmigiano Reggiano, Grana Padano, and Mozzarella di Bufala—find their ideal placement in delicatessens and independent specialty stores, where consumers actively seek quality, authenticity, and personalized service.

THE NEXT CHALLENGE: STORYTELLING AND PDO VALUE

Looking ahead, the challenge will be to preserve this competitive advantage in the face of an improving Canadian domestic industry, which is striving to raise quality standards and production volumes.

Strategic investment in storytelling will be critical—particularly in communicating the added value of PDO (Protected Designation of Origin) and PGI (Protected Geographical Indication) certifications, as well as the artisanal heritage embedded in Italian production.

Italian cuisine enjoys an outstanding reputation across Canada. Yet transforming Italian cheeses into true objects of desire on a national scale requires more than brand prestige. It calls for close collaboration with local importers, in-store tastings, and targeted social media communication capable of reaching not only major metropolitan areas but the full breadth of the Canadian territory.

In an increasingly competitive North American landscape, Italy’s dairy sector has demonstrated that quality, identity, and strategic trade policy can translate into tangible market leadership. The race with the United States remains tight—but the momentum, for now, is unmistakably Italian.

L’articolo The Boom of Italian Cheese in Canada proviene da Italianfood.net.